do pastors pay taxes reddit

Pastors pay under SECA unless they have opted out in which case they pay nothing. Estates are taxed as separate entities by the IRS so income taxes must be filed for the estate.

The Pastor Dies And Is Only Resurrected If She Receives Enough Offerings R Facepalm

Unfortunately the rules for clergy income taxes can be especially confusing.

. In some cases the estate will owe taxes on any income earned through its assets. Pastors Are Dual Status Taxpayers. Do Beneficiaries Pay Taxes on Estate Distributions.

Tax law religious organizations are not required to pay taxes because theyre considered non-profit institutions and because they provide a public good. There are some basic facts that you need to understand about taxes for pastors before we get into how to pay them. Posted by 2 years ago.

But that 300kyr is not actually deducted from the churchs money. However many are skeptical of this reasoning arguing that churches can be enormously profitable and that the only benefits they provide are to their own members. And churches theatres charities shelters etc are non-profit organizations.

Requiring churches to pay taxes would endanger the free expression of religion and violate the Free Exercise Clause of the First Amendment of the US Constitution. A tax exemption has much the same effect as a cash grant to the organization of the amount of tax it would have to pay on its income. This is because pastors always have to pay those taxes under the SECA program as opposed to FICA as if they were self-employed.

Clergy must pay income taxes just like everyone else. In fact not only do they not have to withhold taxes but churches arent allowed to withhold Social Security and Medicare taxes also called FICA or payroll taxes. At smaller churches the pay is usually lower and these pastors may have a side job to supplement their income.

You are considered an employee for retirement plan purposes. Churches should pay taxes. This income is considered employee wages.

Some pastors are considered independent contractors if they arent affiliated. At larger churches pastors are usually full time. If they are a permanent pastor there pay will mostly comes from tithes 10 of church goers income and offerings any extra money someone wants to donate.

While they can be considered an employee of a church for federal income tax purposes a pastor is considered self-employed by the IRS. Non-pastor church employees pay under FICA SECA if your church is exempt. Nor does the pastor pay taxes on it.

A pastor has a unique dual tax status. By taxing churches the government would be empowered to penalize or shut them down if they default on their payments. Pastor total compensation is 365kyr.

Nearly all pastors get paid. That means that you pay income taxes as an employee but pay payroll taxes Social Security and Medicare taxes as if you were self. If the estate pays the appropriate amount in taxes the beneficiary shouldnt be responsible for taxes.

First all ministers by the IRS definition are dual status taxpayers. Some ministers dont realize that even if they are employees of a church they must also send the IRS quarterly payments. Its a whole different branch kf taxation system and it goes way beyond someone voting on taxing the churches.

I want to agree with the idea that multimillion dollar pastors shouldn. Its just reported to make it clear what the pastors total compensation is. To prepare for the tax year its best to understand all the special rules.

FICASECA Payroll Taxes. Pastor has perk equivalent to 300kyr based on fair market rental value. The tax code makes no distinction between authentic religions and fraudulent startup faiths which benefit at taxpayers expense.

The US Supreme Court confirmed this in McCulloch v. Its not about churches not paying taxes its that non-profit organizations dont pay taxes.

It Really Is The Churches Motto Tho R Clevercomebacks

Resisting Disinfodemic Media And Information Literacy For Everyone By Everyone Selected Papers

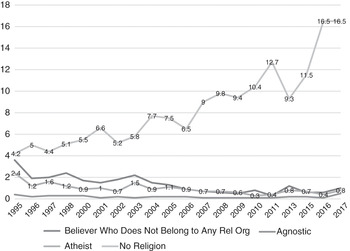

Losing My Religion As A Natural Experiment How State Pressure And Taxes Led To Church Disaffiliations Between 1940 And 2010 In Germany Stolz 2021 Journal For The Scientific Study Of Religion Wiley Online Library

The Pastor Dies And Is Only Resurrected If She Receives Enough Offerings R Facepalm

The Pastor Dies And Is Only Resurrected If She Receives Enough Offerings R Facepalm

Lived Atheism In The Twentieth And Twenty First Centuries Case Studies Part Vii The Cambridge History Of Atheism

Tax Mistakes Ministers Quarterly Tax Estimates Nonprofit Cpa

Losing My Religion As A Natural Experiment How State Pressure And Taxes Led To Church Disaffiliations Between 1940 And 2010 In Germany Stolz 2021 Journal For The Scientific Study Of Religion Wiley Online Library

The Pastor Dies And Is Only Resurrected If She Receives Enough Offerings R Facepalm

Losing My Religion As A Natural Experiment How State Pressure And Taxes Led To Church Disaffiliations Between 1940 And 2010 In Germany Stolz 2021 Journal For The Scientific Study Of Religion Wiley Online Library

Parliamentary Constraints And Long Term Development Evidence From The Duchy Of Wurttemberg Doucette American Journal Of Political Science Wiley Online Library

The Pastor Dies And Is Only Resurrected If She Receives Enough Offerings R Facepalm

Losing My Religion As A Natural Experiment How State Pressure And Taxes Led To Church Disaffiliations Between 1940 And 2010 In Germany Stolz 2021 Journal For The Scientific Study Of Religion Wiley Online Library

Deutsche Bank Ceo Fitschen In Focus Of Tax Fraud Probe Business Economy And Finance News From A German Perspective Dw 12 12 2012

The Pastor Dies And Is Only Resurrected If She Receives Enough Offerings R Facepalm

Interview With Celebrity Pastor Carl Lentz Wwd

The Entanglement Between Religion And Politics In Review Of Religion And Chinese Society Volume 8 Issue 1 2021